Bagley Risk Management : Securing Your Service Future

Bagley Risk Management : Securing Your Service Future

Blog Article

Safeguard Your Animals With Livestock Threat Security (Lrp) Insurance

Animals manufacturers face a myriad of obstacles, from market volatility to uncertain weather. In such a dynamic setting, securing your livestock ends up being extremely important. Livestock Threat Security (LRP) insurance coverage provides a strategic tool for producers to safeguard their financial investment and reduce potential monetary dangers. By comprehending the ins and outs of LRP insurance, producers can make educated choices that safeguard their incomes.

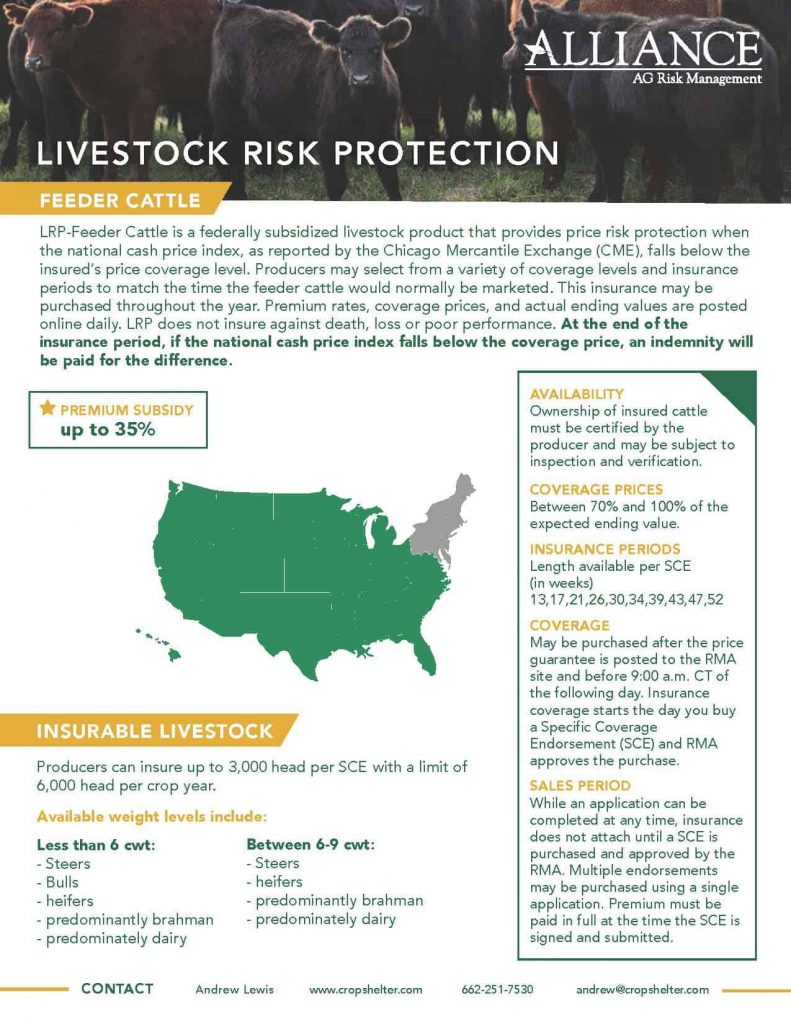

Understanding Livestock Risk Protection (LRP) Insurance Policy

Animals Risk Defense (LRP) Insurance provides essential protection for livestock manufacturers versus prospective monetary losses as a result of market rate variations. This type of insurance policy permits manufacturers to alleviate the danger connected with unforeseeable market problems, guaranteeing a level of economic safety for their procedures. By making use of LRP Insurance, manufacturers can lock in a minimal rate for their animals, securing versus a decrease in market rates that might negatively impact their revenue.

LRP Insurance operates by using insurance coverage for the difference in between the real market and the insured price cost at the end of the coverage duration. Producers can choose coverage degrees and insurance coverage durations that align with their specific needs and risk tolerance. This versatility enables producers to customize their insurance policy to finest secure their monetary rate of interests, giving comfort in an inherently volatile market.

Understanding the details of LRP Insurance policy is essential for livestock manufacturers looking to safeguard their procedures versus market uncertainties. By leveraging this insurance coverage tool successfully, manufacturers can browse market changes with self-confidence, ensuring the long-term practicality of their animals businesses.

Advantages of LRP Insurance for Animals Producers

Enhancing economic safety and security, Livestock Danger Protection (LRP) Insurance provides beneficial safeguards against market cost variations for manufacturers in the livestock sector. One of the vital benefits of LRP Insurance policy is that it supplies manufacturers with a device to handle the danger connected with uncertain market rates. By permitting producers to set a guaranteed price flooring for their animals, LRP Insurance helps shield versus possible losses if market costs drop listed below a certain degree.

In Addition, LRP Insurance coverage makes it possible for producers to make more educated choices concerning their procedures. With the guarantee of a minimum price for their livestock, manufacturers can plan in advance with greater confidence, understanding that they have a safeguard in position. This can cause increased security in income and minimized financial stress throughout times of market volatility.

How LRP Insurance Mitigates Financial Threats

By offering manufacturers with a trusted security web against market rate variations, Livestock Risk Defense (LRP) Insurance coverage properly safeguards their economic security and decreases possible threats. One essential means LRP insurance assists minimize financial dangers is by supplying protection against unanticipated declines in livestock costs. Producers can acquire LRP plans for details weight arrays of animals, enabling them to hedge versus market slumps that might otherwise result in significant monetary losses.

Additionally, LRP insurance policy provides manufacturers with tranquility of mind, knowing that they have a fixed level of price protection. This certainty enables manufacturers to make educated choices regarding their operations without being unduly influenced by unforeseeable market changes. Furthermore, by lowering the financial unpredictability related to rate volatility, LRP insurance policy allows manufacturers to far better strategy for the future, assign resources effectively, and ultimately improve their overall monetary strength.

Actions to Protect LRP Insurance Coverage Coverage

Securing LRP insurance policy protection involves a collection of simple actions that can offer producers with beneficial protection against market uncertainties. The very first step in obtaining LRP insurance is to call an accredited plant insurance policy representative.

When the application is submitted, manufacturers will certainly require to pay a costs based on the insurance coverage level and number of head guaranteed. It is important to assess and understand the policy completely before making any kind of payments to ensure it meets the particular demands of the procedure. Bagley Risk Management. After the premium is paid, manufacturers will get a certification of insurance policy, recording their protection

Throughout the protection duration, manufacturers need to maintain thorough documents of their animals inventory and market costs. In case of a cost drop, producers can file a claim with their insurance agent to receive settlement for the distinction in between the insured rate and the marketplace rate. By adhering to these actions, producers can guard their animals procedure against monetary losses created by market fluctuations.

Maximizing Value From LRP Insurance

To extract the complete benefit from Livestock Risk Protection Insurance, manufacturers should purposefully make use of the insurance coverage options available to them. Making the most of the value from LRP insurance coverage includes an extensive understanding of the policy functions and making educated decisions. One crucial strategy is to meticulously examine the insurance coverage levels and duration that ideal align with the specific needs and threats of the animals operation. Manufacturers need to likewise routinely evaluate and adjust their insurance coverage as market conditions and threat elements evolve.

Moreover, manufacturers can enhance the worth of LRP insurance coverage by leveraging corresponding risk monitoring devices such as futures and alternatives agreements. By diversifying risk administration approaches, producers can minimize potential losses extra successfully. It is vital to remain educated concerning market trends, government programs, and market advancements that might affect animals prices and run the risk of management techniques.

Ultimately, making the most of the worth from LRP insurance needs proactive planning, ongoing surveillance, and versatility to changing conditions. By taking a calculated technique to run the risk of administration, useful source producers can secure their livestock procedures and boost their total monetary security.

Verdict

In verdict, Animals Threat Security (LRP) Insurance policy supplies important advantages to animals producers by alleviating financial risks connected with changes in market prices. Bagley Risk Management. By safeguarding LRP insurance policy protection, producers can safeguard their check out this site livestock financial investments and possibly raise their productivity. Comprehending the actions and advantages to take full advantage of worth from LRP insurance is vital for livestock manufacturers to efficiently manage dangers and secure their services

Livestock Danger Security (LRP) Insurance gives crucial coverage for animals producers versus prospective financial losses due to market price variations.Enhancing economic safety and security and security, Animals Danger Protection (LRP) Insurance coverage offers valuable safeguards versus market cost fluctuations for producers in the livestock market.By giving manufacturers with a dependable security web against market rate variations, Livestock Threat Protection (LRP) Insurance policy successfully safeguards their financial stability and lessens potential risks. The first action in obtaining LRP insurance policy is to get in touch with a qualified crop insurance representative.In final thought, Animals Risk Protection (LRP) Insurance policy uses useful benefits to livestock producers you could try here by minimizing monetary dangers associated with variations in market costs.

Report this page